What is AMLcheck?

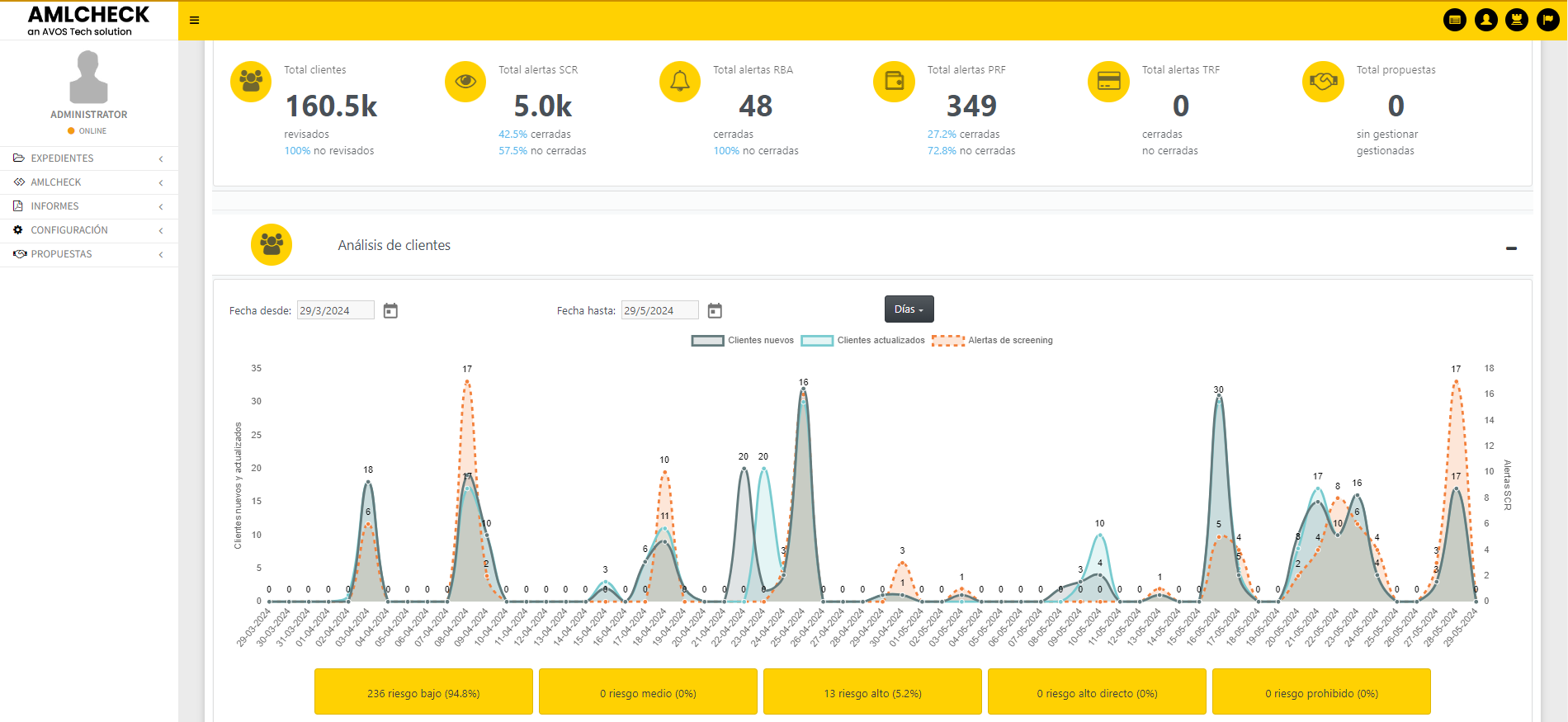

AMLcheck is an anti-money laundering and counter terrorist financing software. Using a single AML (Anti-Money Laundering) software, companies can prevent, detect and investigate suspicious activity. AMLcheck is the most advanced solution for regulatory compliance when it comes to anti-money laundering.

AMLcheck Features

AMLcheck makes it possible to perform functions including but not limited to identifying people or assets during the onboarding process, performing the mandatory KYC for customers by establishing a profile or score based on the available information and analyzing transactions applying different control scenarios to detect anomalous behaviors.

Our partner in this venture is Dow Jones Risk & Compliance, a global leader in data intelligence for anti-money laundering, corruption and economic sanctions.

At AMLcheck, we provide our customer with information from more than 500 official sanctions lists (OFAC, SECO, UN, etc.) and information on Politically Exposed Persons (PEPs) in line with international guidelines on Anti-Money Laundering and Counter Terrorism Financing (FATF, Wolfsberg Principles, European Union, etc.). This database is continuously updated with information on almost 2 million people worldwide.

Benefits of AMLcheck

Compliance with AML/CTF regulations

Decrease in legal and reputational risks

Deduction in operating costs

Verification of suppliers and third parties

AMLcheck Characteristics

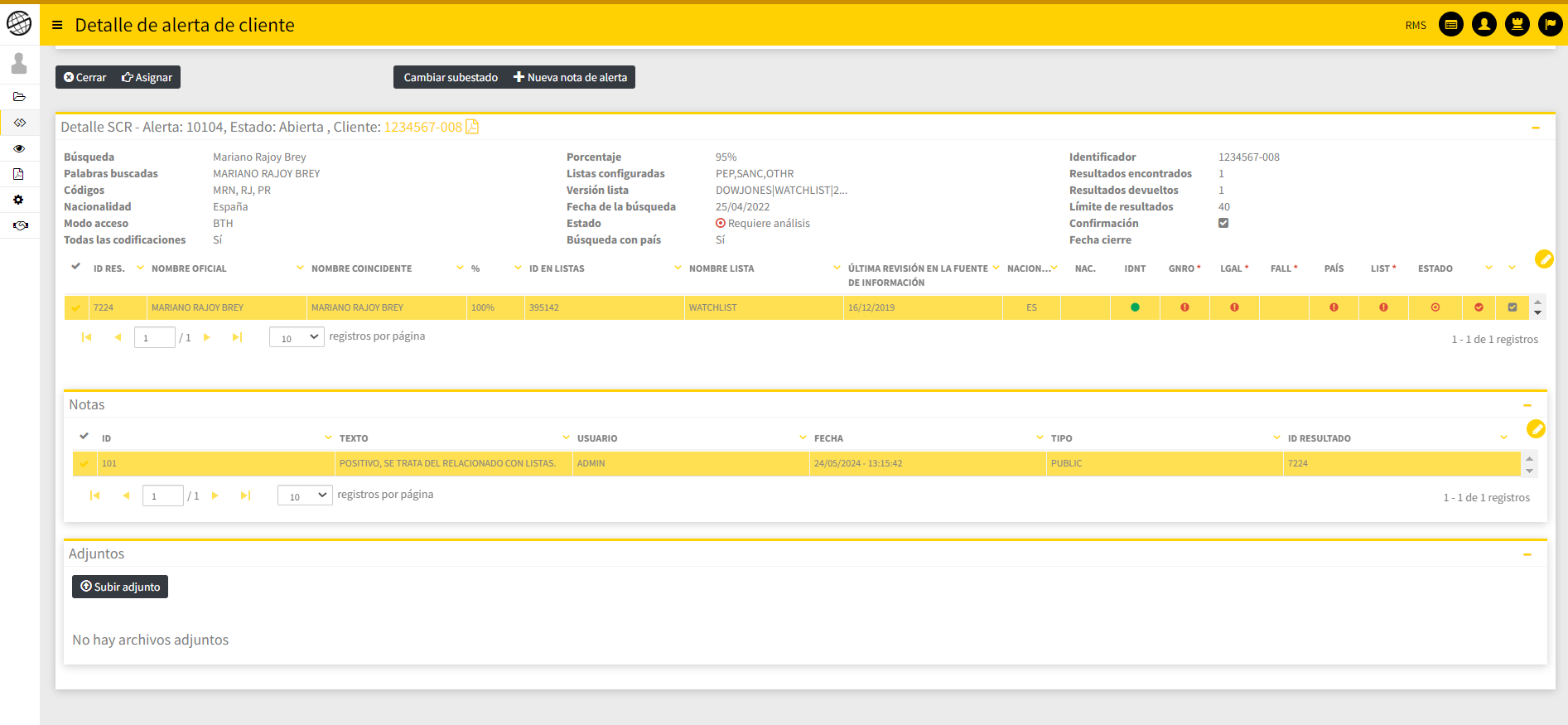

Effective screening process

During the onboarding process, AMLcheck allows you to manually and automatically check the names of both individuals and assets against sanctions and PEPs lists. This process is performed effectively using an algorithm that takes typographical and phonetic errors into consideration to improve the quality of results and reduce the possibility of false positives being returned.

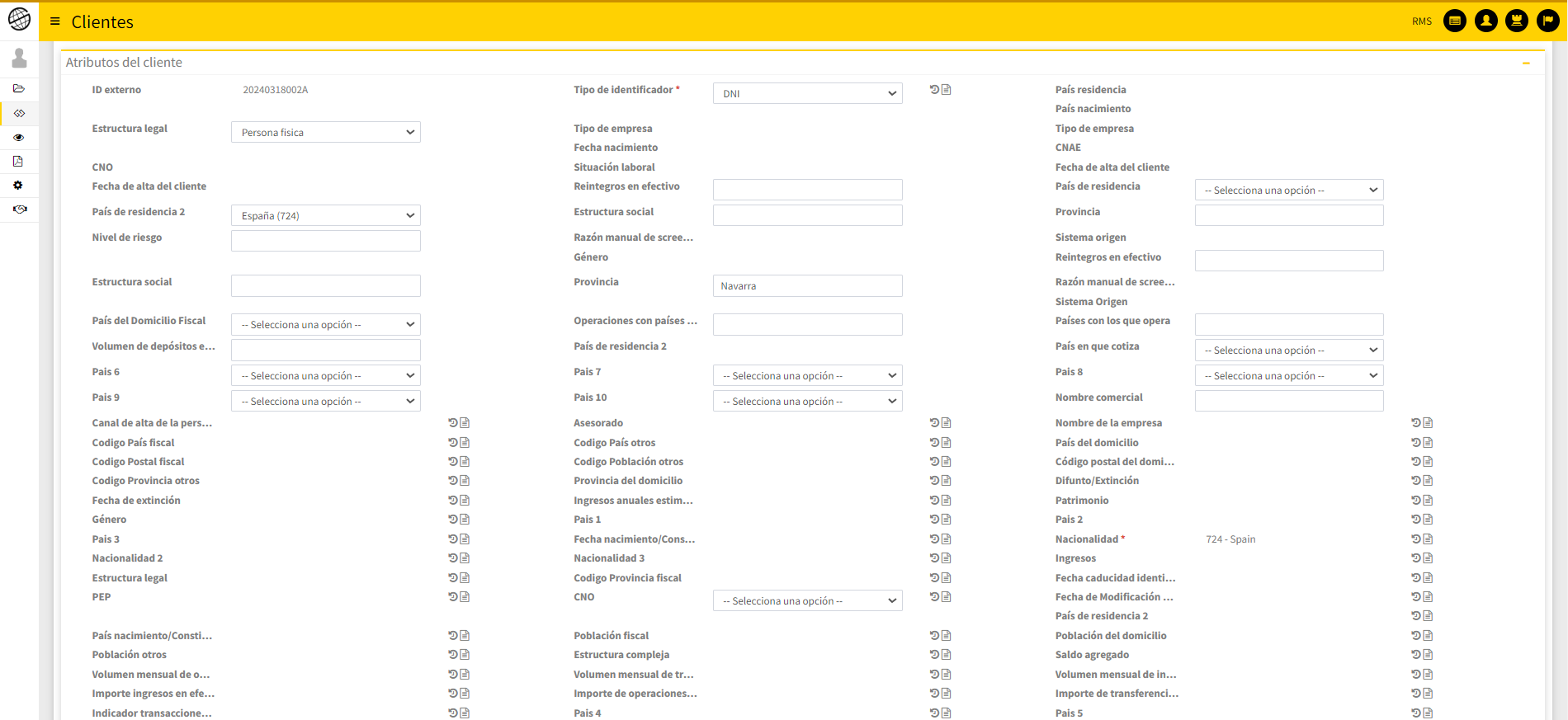

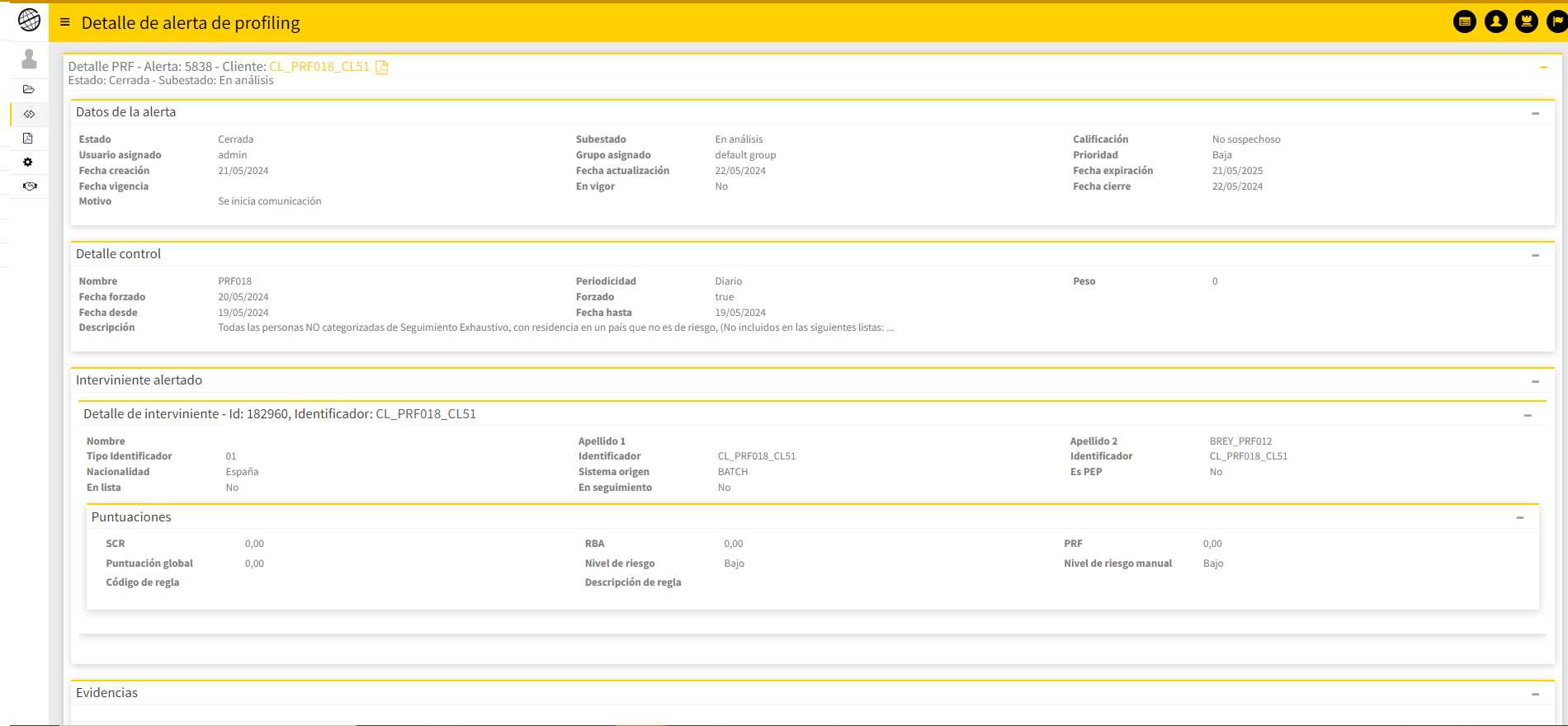

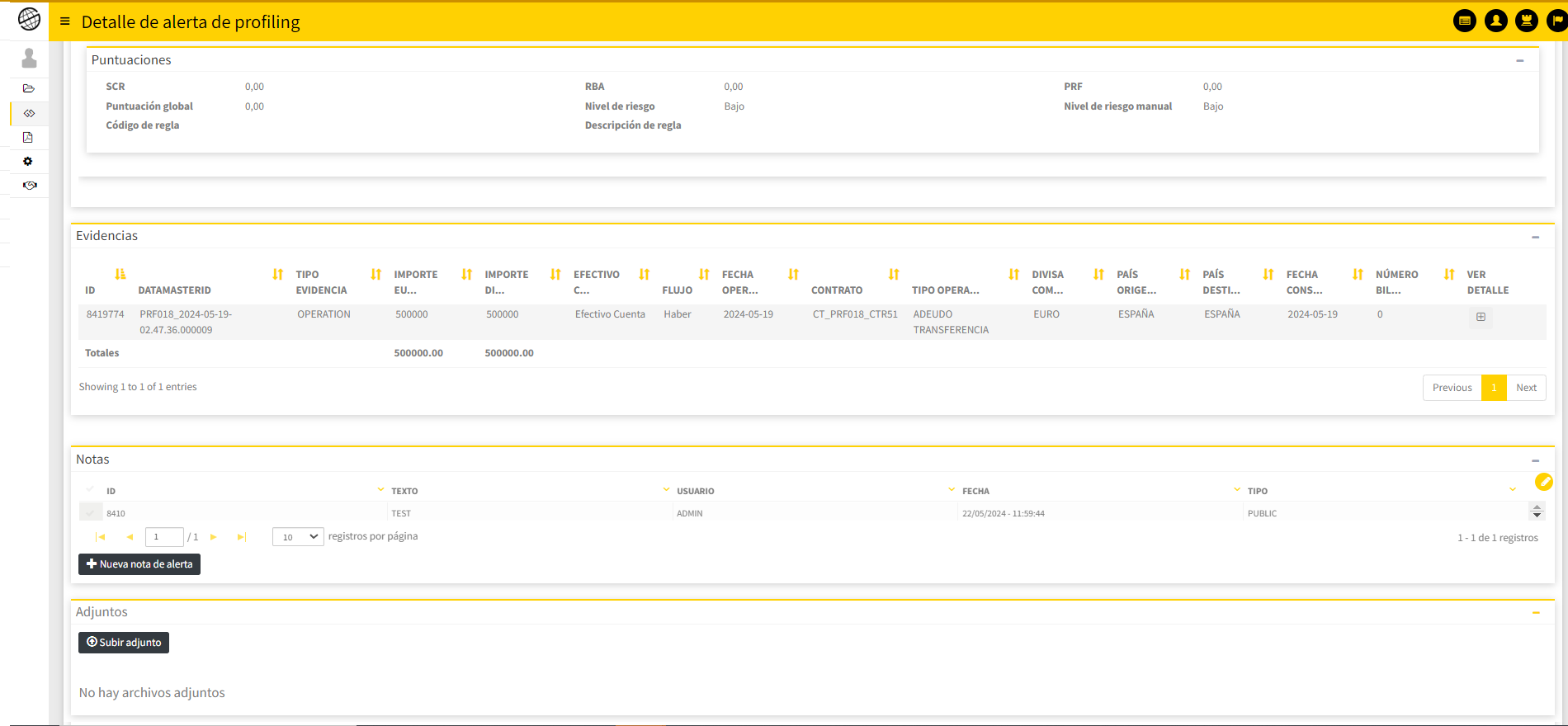

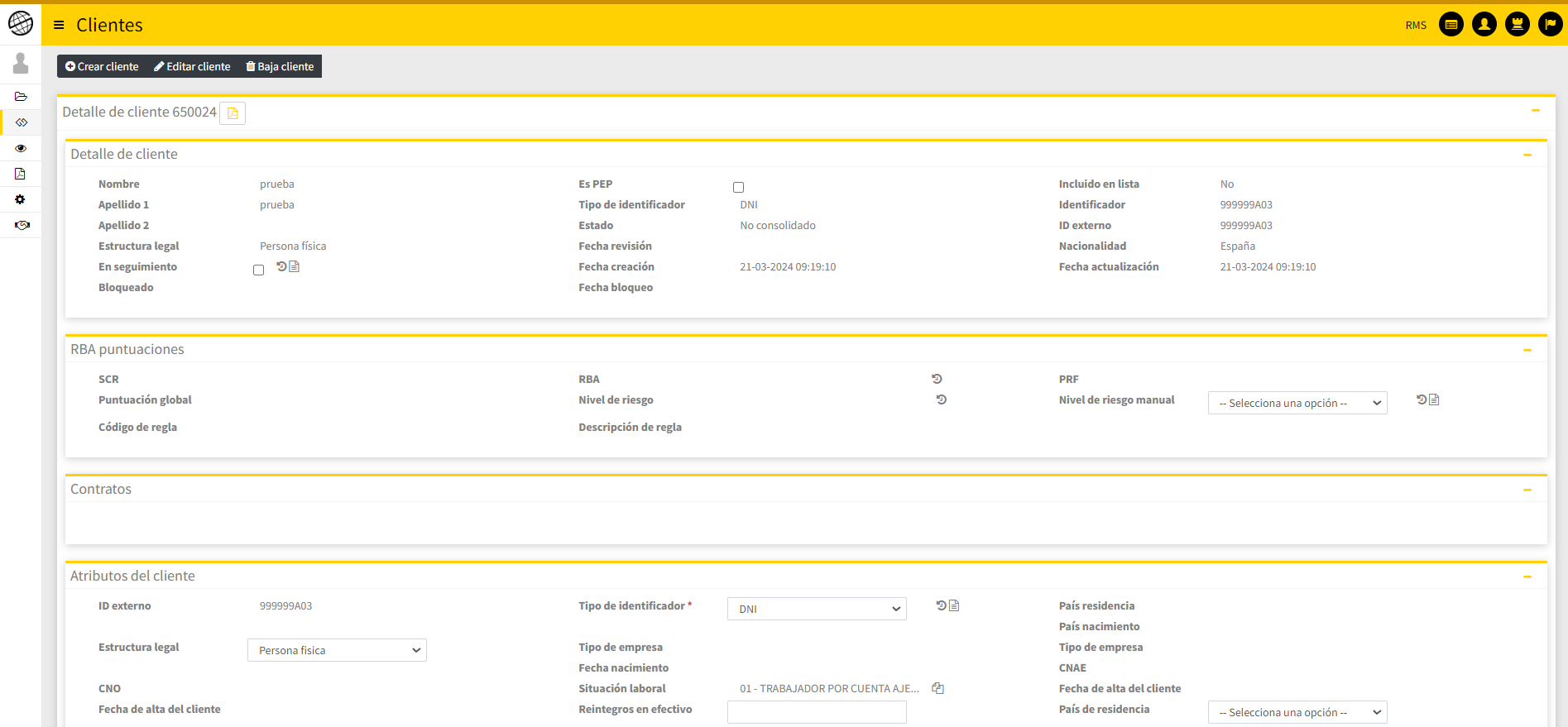

KYC (Know-Your-Client) and Risk Score

In line with the main global directives on AML (FATF, FinCEN and the EU Directives for anti-money laundering and counter terrorist financing), AMLcheck makes it possible to perform a detailed analysis of each customer based on the information/documentation obtained in the KYC (Know-Your-Client) processes to establish the risk profile (score or RBA -Risk Based Approach-) and continuously monitor their activities.

The calculation of this score is adapted to each type of customer, activity and business. Parameters can be set and it is forever changing depending on how data and transactions are updated.

Access to up-to-date lists

AMLcheck provides the customer with access to sanctions and PEPs lists from our partner, Dow Jones Risk & Compliance.

It can also be combined with other different lists, both public (OFAC, EU, etc.) and private that the customer has access to, whether they are owned by them or obtained as part of an agreement with a third party.

Task and Report Manager

AMLcheck is a useful tool for Compliance teams. It comes equipped with the option of generating analytics and reports. Its task manager allows you to organize and assign tasks and the platform itself allows you to prepare documents and communications based on the specifications of regulators.

Global AML solution

AMLcheck is a multicustomer and multilanguage platform. The customer can choose between on-premise or SaaS options depending on their needs.

AMLcheck covers all activities and businesses, from financial and insurance to retail, in addition to all geographical areas and jurisdictions.

AMLcheck Success Story

Discover how AMLcheck transformed a leading Real Estate Servicer in just six months

AMLcheck enabled a leading servicer to manage over 200,000 cross-referenced participants, improving their operations and regulatory compliance.

Outsourcing the AML/CFT Technical Unit

At AVOS Tech, we offer an outsourcing service for control and monitoring defined for each obligated entity. We help companies comply with current AML/CFT regulations through our Compliance BPO team.

.png)